Jony Ive's come back?

A phone from OpenAI, crypto struggles, new Roosh Ventures portfolio company, new payment technology, and more.

🗞 In the Know

The WSJ is reporting that OpenAI is seeking to conduct a secondary sale of its shares at a valuation of up to $90B, a 3X markup over a similar share sale it completed earlier this year. The company will reportedly generate $1 billion in revenue this year.

Chase is banning crypto transactions for UK customers, citing high rates of fraud and scams. Chase is following NatWest, Santander, and HSBC, which have all curbed or banned UK clients’ access to crypto within the last year.

Apple is “soft launching” a feature that enables real-time connectivity to supporting bank accounts via the United Kingdom’s Open Banking API. The offering will allow Apple cardholders with a connected bank account to view their balances and payment history directly in the Wallet app.

Jony Ive, the renowned designer of the iPhone, and OpenAI CEO Sam Altman have been discussing building a new AI hardware device. A report says that OpenAI is talking with both Ive and SoftBank to launch a venture to build the “iPhone of artificial intelligence," fueled by more than $1B in funding from the Japanese conglomerate.

🏁 VentureVista

Series, a startup that is developing software to centralize and automate businesses' finance and operations stacks, raised a $25M seed and Series A round led by 776 and Basis Set Ventures, with participation from Pear VC, Kleiner Perkins, Day One Ventures, Hustle Fund, Caffeinated Capital, and Wischoff Ventures.

As companies grow, they create legal entities and organizational structures to support their lines of business — each with their respective governance and compliance needs. Quickly, keeping track of this can get complex - Series is resolving this issue.

Apron, a fintech platform that slashes the time small businesses spend processing invoices, announced that it has raised a $15M Series A funding round led by Index Ventures, with Bessemer Venture Partners and Visionaries Club participating.

Apron is specifically targeting small companies that don’t have a finance department, and that simply don’t use any specific tool to track and pay invoices. They rely heavily on email chains and their online banking portal.

Vega, a wealth tech platform provider, raised over $8M in equity funding. Backers included Motive Ventures (lead), Picus Capital, Citi Ventures, No Label Ventures, GFC, and 60+ senior financial services and fintech executives.

Vega enables users to invest across the asset allocation spectrum and build diversified portfolios covering both private asset classes such as private equity, venture capital, private credit, and real assets, as well as public equities, fixed income, and commodities.

PartyKit, a startup that has built an open-source platform for companies looking to integrate multiplayer functionality into their apps, raised a $2.5M pre-seed round led by Sequoia Capital, with Cursor Capital and Remote First Capital also contributing.

If a developer is tasked with building real-time multiplayer collaboration into their software, PartyKit with an open-source deployment platform replete with all the libraries needed for companies looking to integrate multiplayer functionality into their apps.

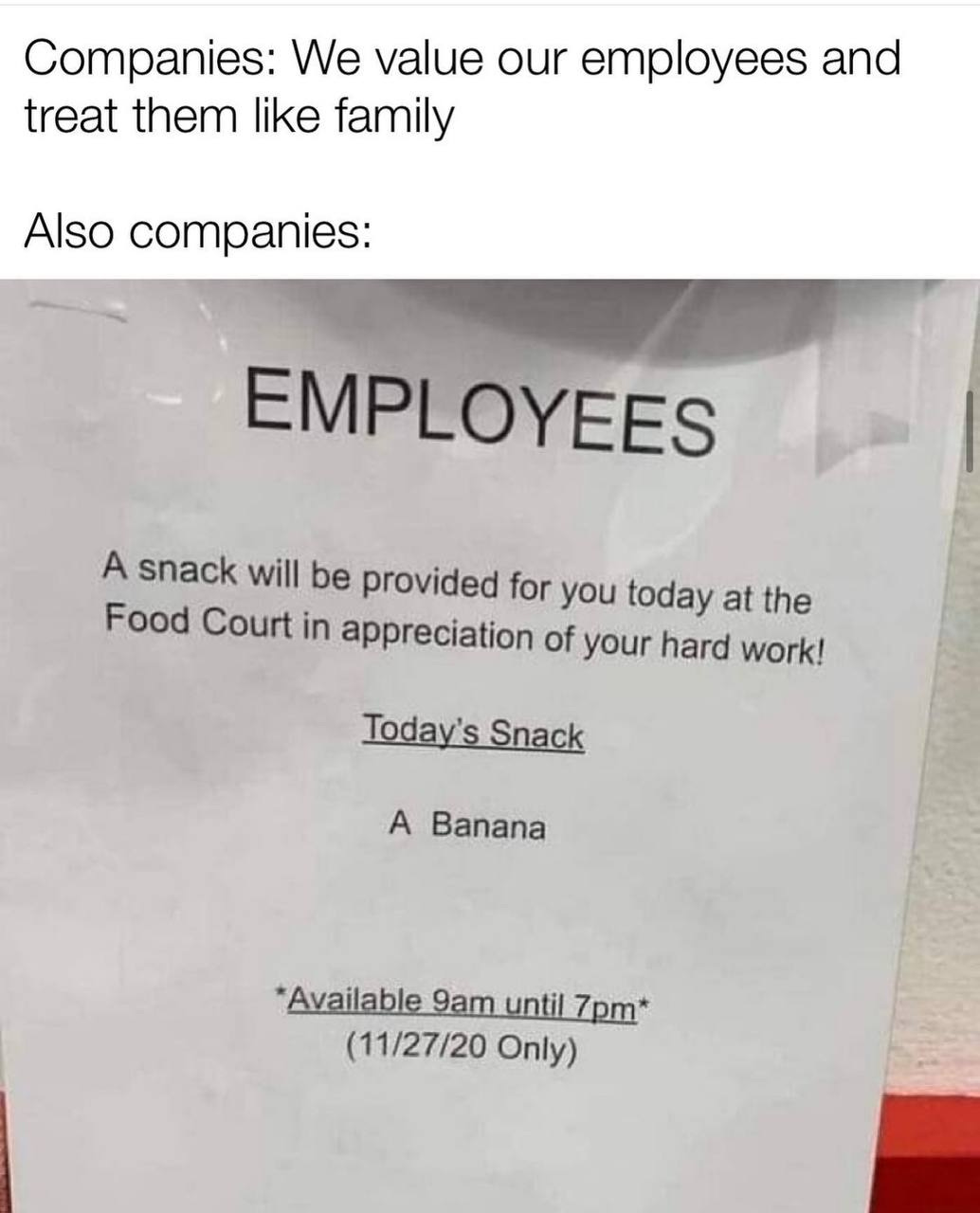

Rollstack, has raised $1.8M in seed funding from investors, including Y Combinator, Roosh Ventures, UpHonest Capital, Kima Ventures, and Monte Carlo Capital. Please welcome a new company in the Roosh Ventures portfolio 🚀

Rollstack has all the ingredients of a tech investment success story. A team boasting extensive tech expertise from startups to industry giants like Deel and Pinterest, they’re poised to revolutionize a $7.4B data visualization market with immense disruption potential. Their product helps to automate a lot of data visualisation processes, offering unparalleled efficiency and already piquing the interest of tier 1 companies. Roosh Ventures is thrilled to be part of this story and we are confident that Rollstack is the future of innovation in its sector.

🔥 Exits:

Letterboxd, a bootstrapped company from New Zealand that operates a social network for recommending and reviewing movies, sold a majority stake to a Canadian public company called Tiny at a $50M+ valuation. WSJ notes Letterboxd grew quietly for many years, a relative oasis amid the quagmire of social media. Then, the app’s popularity surged during the Covid-19 pandemic. By the end of 2021, Letterboxd had more than 4.1M registered users, up from about 1.8M in March 2020.

💡Innovation Spotlight

Account management advancement from Atomic: Atomic released an interesting new open banking tool called PayLink. One of the pain points for switching bank accounts is all the recurring payments from that account. Until now, each one had to be done manually. With PayLink technology, users can log in securely to each merchant in one session, where Atomic will provide a Plaid-like interface for updating the payment accounts.

AI assistant from Morgan Stanley: Morgan Stanley released an AI Assistant that allows financial advisors quick access to the bank’s database of about 100K research reports and documents. The most common use cases are report inquiries and administrative questions.

📈 Insightful Data

AI technology value distribution. According to a study from Capital Economics, which ranks countries according to their potential to benefit from AI, rich nations will become the biggest winners. The US topped the rankings, followed by Singapore, the UK, and Switzerland, which broadens the inequality gap.

Venturized is compiled and written by Ivan Taranenko, Associate at Roosh Ventures.

Roosh Ventures is a Kyiv-based entrepreneurs-led, generalist VC firm investing in Pre-seed to Series A across EU and US markets. Powered by Roosh.

Join the Roosh Ventures fam on 🐥 Twitter and 🔗 Linkedin. More about Roosh Ventures and its portfolio companies on 🌐 roosh.vc.