Interesting news

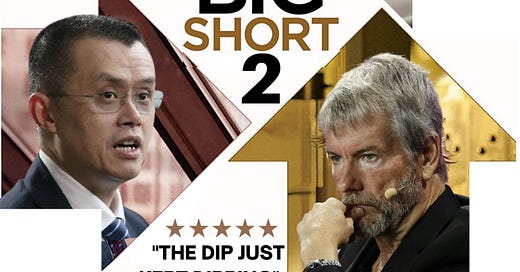

📢 The whole market is talking about it - FTX and Sam Bankman-Fried. If you missed it - on Nov. 2, CoinDesk reported on a leaked document that appeared to show that Alameda Research, a hedge fund also run by Bankman-Fried, held an unusually large amount of FTT tokens. FTX and Alameda are meant to be separate businesses, but the report claimed they had close financial ties. Binance, one of the investors in FTX, announced on Nov. 6 that it would sell its FTT tokens “due to recent revelations.” In response, FTT’s price plummeted, and traders rushed to pull out of FTX. FTX scrambled to process requests for withdrawals, which amounted to an estimated $6B over three days. Finally, there were many talks about a possible acquisition of FTX by Binance, but in the end, nobody didn’t save the company, and FTX filed for bankruptcy. Read the full story here.

📢 TikTok’s user base and revenues have exploded over the last few years. Now the major music groups that license their music to the video-sharing app want a bigger piece of the pie. The music groups are weighing how to best increase their payouts from TikTok without getting into a public dispute with one of their most important partners. TikTok has positioned itself as a promotional tool that doesn’t need to pay in the same way as Spotify or YouTube. It’s a complement to music listening, not a replacement for it, the company argues.

📢 Elon Musk emailed Twitter employees for the first time late last week to prepare them for “difficult" economic times ahead and to ban remote work unless he personally approves it. The new rules, which kick in immediately, mandate that employees be in the office for at least 40 hours per week. Also, there is full chaos going on right now with blue check marks available for some paying subscribers – lots of accounts were created writing fake news (some of them resulted in quite solid money losses).

📢 Meta is laying off 13% of its staff, or more than 11,000 employees, CEO Mark Zuckerberg told the company, after which staffers were alerted via email whether their role was being impacted by the layoff. He said Meta is making reductions in every organization but that recruiting will be disproportionately affected since the company plans to hire fewer people next year.

Notable deals

Venture capital:

🚀 Mem, a startup whose note-taking app revolves around search and a chronological timeline and allows users to attach topic tags, tag other users, and add recurring reminders to notes, raised a $23.5M led by OpenAI Startup Fund at a $110M post-money valuation. Mem users can capture quick notes, send links and save images from anywhere using SMS, messaging apps, and the platform’s mobile client. Collaboration features let teams share, edit and comment on notes and directly attach them to shared calendars for faster reference.

🚀 Fordefi, a startup that is developing a crypto wallet for institutions, raised an $18M seed round led by Lightspeed Venture Partners and joined by Electric Capital, Jump Crypto, Castle Island, Pantera Capital, Illuminate Financial, PayPal Alumni Fund, Nima Capital, Digital Currency Group, Defiance Capital, StarkWare and Alameda Research. The company emerged from stealth last week and is led by a founding team with serious crypto background, including CEO Josh Schwartz, who previously ran global sales at BitGo and was COO at Curv. Fordefi’s first product is a DeFi-focused wallet built for institutional investors and crypto-native funds working with decentralized applications.

🚀 Equals, a startup that is building a spreadsheet product that can build analyses with real-time data directly from a database or data warehouse, with or without using sequel query language, raised a $16M Series A round. Andreessen Horowitz was the deal lead; additional investors included Craft Ventures, Box Group, Worklife, and Combine. Aside of mentioned above, Equals will soon be able to import scripts to allow users to connect spreadsheets to different APIs and internal tools with JavaScript or Python. Also on the way are pivot tables and connectors to business intelligence apps from Salesforce, QuickBooks, Stripe, and Google Analytics.

🚀 EdgeDB, a San Francisco startup founded this year that is building a next-generation relational database, raised a $15M Series A round. Nava Ventures and Accel co-led the deal. EdgeDB’s product is fundamentally a relational database or a collection of data items with predefined relationships between them. But the CEO makes the case that EdgeDB “reinvents pretty much every concept” about relational databases, introducing its own high-level data model, a query language called EdgeQL, a low-latency network protocol, and a set of tools to handle day-to-day operations like installing the database and making backups.

🚀 5Mins, a London startup that adds adds gamification, social features, and personalization to corporate training videos, raised a $5.7M seed round led by AlbionVC, with Chalfen Ventures, Edenred Capital, Portfolio Ventures, and Blue Lion Global also pitching in. The company is aiming to level the playing field for employee learning and development, giving SMBs and mid-market companies the best possible toolkit to unlock their teams’ potential. The goal is to even out the talent development pipeline. “While SMBs and Mid-Market companies will never have the Talent Development budgets big corporates have, with 5Mins we provide them with the most effective L&D tools to keep their employees engaged and to retain them for longer,” founder says.

Exits:

🔥 Forbes, the media company whose SPAC merger collapsed over the summer, is in talks to sell to a “consortium of family offices and global investors" says the company. The New York Times says the outfit had been seeking at least $800M in a sale but that, according to its sources, the final price will most likely be below that.

Promising technology

👾 Advanced Micro Devices launched its highest-performing data center processors ever with the debut of the 4th Gen Epyc processors. The 4th Gen AMD Epyc processors can help businesses free up data center resources to create additional workload processing and accelerate output. The chips have up to 96 cores in a single processor, enabling customers to deploy fewer and more powerful servers to continue to meet their computer needs, AMD said.

👾 Zoom adds Cresta’s conversational AI to help customer service agents. The company is integrating its AI tools with Zoom to improve the service when customers contact companies through a video call. The integration effectively allows businesses using Zoom to activate Cresta directly through Zoom’s interface.

PS: Cresta uses AI to improve customer service – its tool, the Cresta Agent Assist, offers suggestions to live humans using customer records and knowledge of what’s worked in the past. The suggested responses handle both strategic challenges, like steering the customer to the best product, while also managing tactical details, like checking grammar and deploying stock answers that are already edited.

Insightful data

Sometimes it may hurt. According to TheInformation, the biggest VC losers in the FTX story include Paradigm, a cryptocurrency-focused investor, and Sequoia Capital. These firms lost $278M and $214M, respectively. Other losers include SoftBank ($100M), Tiger Global ($38M), the Singapore government investment fund Temasek ($200M), and the Ontario Teachers’ Pension Plan ($95M).