Venturized. May 29th, 2023

Neuralink received FDA clearance, Nvidia approaching $1 trillion valuation, Tesla's Model Y is the best-selling vehicle in the world in Q1'2023, and more

Interesting news

📢 Elon Musk's Neuralink received U.S. Food and Drug Administration (FDA) clearance for its first-in-human clinical trial, a critical milestone for the brain-implant startup as it faces U.S. probes over handling animal experiments. The FDA approval "represents an important first step that will one day allow our technology to help many people," Neuralink said in a tweet on Thursday.

📢 Paradigm, one of the largest crypto-focused VC firms, is broadening its crypto-only focus to areas including AI. A line on the website that said, "We believe crypto will define the next few decades," was removed from the home page, which now does not mention web3 or blockchains.

📢 AI chip maker Nvidia is rapidly approaching a trillion(!) dollar valuation, as the company's stock hit a new all-time high last week. The demand for the chips needed to train the latest wave of generative AI systems, such as ChatGPT led Nvidia to issue a revenue forecast far ahead of Wall Street expectations. The chipmaker said it expected sales to reach $11B in the three months ending in July, more than 50% ahead of analysts' expectations.

📢 OpenAI has closed an investment fund with more than $175M in capital commitments, according to an SEC filing. OpenAI has been investing in startups working in artificial intelligence for a while, though the company initially said it would put $100M into the fund.

📢 Tesla's Model Y crossover SUV was the best-selling vehicle in the world during the first quarter of 2023, according to Motor1.com. This doesn’t just mark the first time that a Tesla has earned that distinction; it’s the first time any pure electric car has topped the global sales rankings period.

Notable deals

Venture capital:

🚀 Poolside, a startup that is building a platform enabling developers to write code using AI, raised a $26M seed round. Redpoint Ventures was the deal lead. (Co-founder and former GitHub CTO Jason Warner is a managing director at Redpoint.)

Poolside is already in talks with a large technology company about a partnership. “We are targeting a trillion parameter model,” CEO Jason Warner said. “When we talked to the hyperscaler, we went from cloud scaler credits to C-level of conversations really quickly.”

🚀 DataOps.live, a startup that helps organizations build, deploy, and manage data pipelines, raised a $17.5M Series A round. Investors included Notion Capital as well as previous investors Anthos Capital and Snowflake Ventures.

The problems that DataOps.live is addressing are commonplace in the world of data analytics: working with data across multiple containers and other locations can lead to slower development times, work backlog, and problems with version control — all issues that get compounded and more complex as data pipelines grow. The pitch that DataOps.live makes is that its platform can help reduce the costs of managing and working with data by 30% by automating repetitive tasks and by providing more insight into how data is moving to improve efficiency and security.

🚀 Kira Learning, a startup that claims it is building an AI-powered platform that allows anyone to teach and learn computer science, raised a $15M Series A round. NEA and the AI Fund co-led the deal.

The company works to establish computer science and AI as foundational pillars of education alongside literacy and numeracy by offering a curriculum designed by notable educators, scientists, and engineers, along with AI-assisted lesson planning, grading, and student assistance.

🚀 Onyx Private, a startup that aims to provide private banking and investment services to high-earning millennials and Gen Zers, raised $4.1M. Investors included Village Global, Y Combinator, Global Founders Capital, One Way Ventures, 186 Ventures, and Olive Tree Capital.

Onyx Private offers digital banking services, including checking accounts, a debit card, and cashback on payments and purchases. On the investment side, the fintech develops investment portfolios from high-yield, fixed-income portfolios, like cash-sweep accounts and U.S. treasury bills, with $100 minimums and low fees. There is an application process to join Onyx Private, and customers can choose between a free plan or a premium plan that is $50 per month or $40 per month if they pay the membership in one payment.

🚀 Loot Labs, a startup that is launching a new platform for digital collectibles that brings the “loot box” mechanic from video games into the NFT space, raised a $1.5M pre-seed round led by BITKRAFT Ventures, with Polygon Ventures, Mechanism Capital, and Lofty Ventures Syndicate also taking part.

Loot Labs‘ new project, Boxed.gg offers all-virtual mystery boxes that can contain a variety of digital collectibles, which can range from rare pieces of NFT art to avatars that can be used on popular websites like Reddit. This is similar to the randomized loot boxes that can be found in popular video games, such as World of Tanks or Valve’s Counter-Strike: Global Offensive.

Exits:

🔥 Meta sells Giphy to Shutterstock for $53M after buying it for $400M. The announcement comes some seven months after the U.K.’s antitrust authority issued a final order for Meta to sell Giphy, on the grounds that the merger reduced dynamic competition.

🔥 Snowflake announced during its quarterly earnings report that it has agreed to acquire Neeva, a search startup founded by former Google executives. Snowflake chairman and CEO Frank Slootman said, “This will enable Snowflake users and application developers to build rich search-enabled and conversational experiences,” he added, “and we believe Neeva will increase our opportunity to allow non-technical users to extract value from their data, more broadly.”

Promising technology

👾 Language expansion. Meta has built AI models that can recognize and produce speech for more than 1,000 languages — a tenfold increase on what’s currently available. Meta is releasing its models to the public via the code hosting service GitHub. It claims that making them open source will help developers working in different languages to build new speech applications.

Insightful data

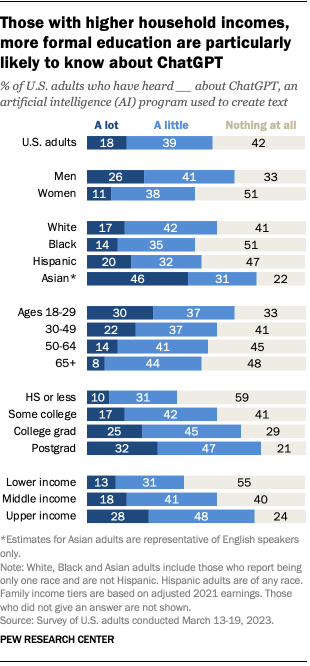

ChatGPT adoption - is it high or low? Overall, 18% of U.S. adults have heard a lot about ChatGPT, while 39% have heard a little and 42% have heard nothing at all. But there are considerable demographic differences in awareness of this chatbot.

For example, roughly 8/10 adults with a postgraduate degree have heard a lot (32%) or a little (47%) about this artificial intelligence program, while 71% of those with a bachelor’s degree say the same. A smaller share of those who have some college education (59%) say they’ve heard of it. By comparison, 41% of those with a high school education or less are familiar with ChatGPT. A similar pattern emerges with household income, as a higher share of people from more affluent households are aware of this program.