Marc Andreessen - Techno-Optimist, or Tech Bubble Engineer?

Greycroft shifts focus, Marc Andreessen VS Techcrunch, A2A push, and whether we still need banks for lending business.

🗞 In the Know

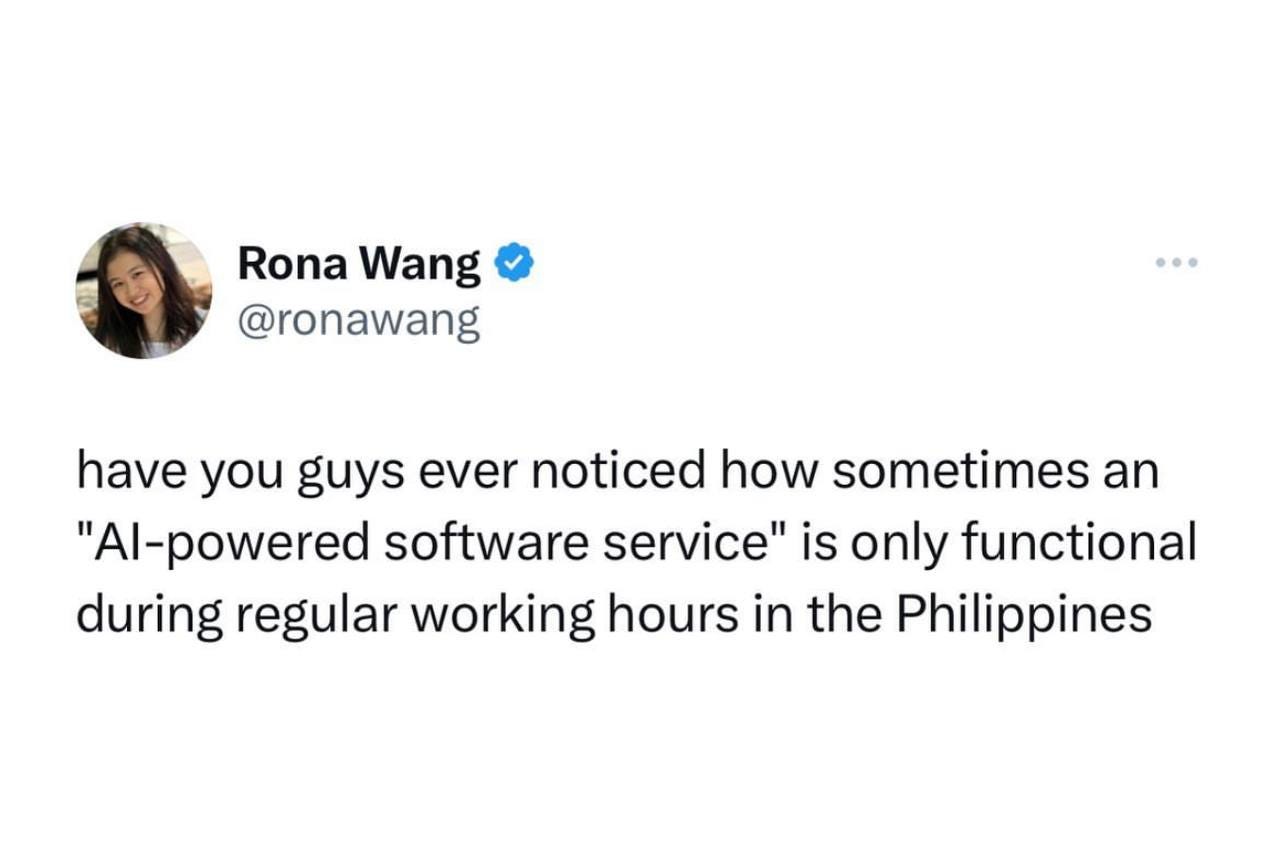

Anthropic asked 1,000 Americans to come up with a set of principles to govern the use of AI. The experiment, called "Collective Constitutional A.I.," is based on Anthropic's previous work on Constitutional A.I., which involves training large language models using a written set of principles. The main objective of this experiment is to provide a chatbot with clear guidelines on how to handle sensitive requests, identify topics that are off-limits, and behave in accordance with human values.

Venture capital firm Greycroft last week told investors that it will refocus its core strategy around AI startups, according to a letter obtained by Axios. The move will result in two longtime partner departures – Ellie Wheeler, an 11-year Greycroft vet who focuses on health care, and Will Szczerbiak, who joined Greycroft in 2015 with a heavy focus on enterprise fintech. Greycroft's commitment is quite hard, the 88-year-old co-founder and chairman Alan Patricof recently told Axios that AI is a "bigger and more profound revolution" than gene splicing, PCs, the internet, or cloud computing."

Marc Andreessen published a new blog post called “The Techno-Optimist Manifesto” last week, emphasizing the positive potential of technology for addressing complex global challenges. However, TechCrunch seems didn’t like Marc’s visionary view, and came out with an article criticizing the blog “When was the last time Marc Andreessen talked to a poor person?”, calling a16z co-founder “a product — and an engineer — of a tech bubble that doesn’t understand the people whom it purports to serve”. Both articles are worth reading!

Wall Street incumbents struggle in consumer banking, with Goldman Sachs consumer profits dropping by 33%, led by consumer BNPL business write-down. For Goldman, the objective of entering consumer checking, lending, BNPL, and partnerships like Apple Card was to diversify away from Investment Banking and trading, but everything did not go as smoothly as planned

X (ex-Twitter) is adding a new subscription tiers. The platform said that one tier will cost lower than the current $8/month plan but won’t reduce ads. The other tier will be a more expensive one, which will remove all ads. The current premium plan promises to show “half ads” to subscribers.

🏁 VentureVista

Luzia, a startup that offers an artificial intelligence assistant, has secured €9.5M in funding from Khosla Ventures, Abstract Ventures, FJ Labs, and Globo Ventures.

Luzia is trying to introduce AI chatbot tech to users through a WhatsApp or Telegram-based bot, making AI services more available. The startup said more than 17M users have interacted with Luzia to date, with 8M of them active on a monthly basis.

Flanks, an open wealth platform startup, has secured $8M in a Series A round led by Earlybird Venture Capital, and followed by the existing investors JME Ventures and 4Founders Capital.

Flanks offers a single API for aggregated wealth data across custodians, providing clients with a rounded view of their investment portfolio in real time. It is compatible with more than 300 banks internationally and aggregates more than half a million investment portfolios monthly.

Bluebirds, a startup that says it uses AI to target sales prospects, raised a $5M seed round from Lightspeed Venture Partners.

Bluebirds differentiates itself by using AI to identify specific triggers that provide GTM teams with valuable insights on which prospects to focus on. This allows them to efficiently target the most appropriate person with the most effective message at the optimal time and on a larger scale.Riffusion, a startup whose AI-powered app can create original music from text, raised a $4M seed round led by Greycroft, with South Park Commons and Sky9 also kicking in.

“[The new Riffusion] empowers anyone to create original music via short, shareable audio clips,” Co-Founder Seth Forsgren told TechCrunch in an email interview. “Users simply describe the lyrics and a musical style, and our model generates riffs complete with singing and custom artwork in a few seconds. From inspiring musicians, to wishing your mom ‘good morning!,’ riffs are a new form of expression and communication that dramatically reduce the barrier to music creation.”

🔥 Exits:

Moment, a platform for events and ticketed experiences, was recently acquired by Patreon. Patreon plans to integrate elements of Moment into its suite of tools for creators. A spokesperson for the company told TechCrunch in an email that livestreaming is one of the most requested features by Patreon creators.

The Information is reporting that SMB neobank Rho Technologies may be interested in acquiring Creative Juice, a startup that provides a suite of products and services to help creators manage their income, expenses, taxes, and invoices, known for its partnership with YouTube superstar MrBeast, who is also an investor. A completed deal would mark at least the second acquisition so far this year by Rho, which has raised more than $200M including debt from investors including Dragoneer Investment Group and M13.

💡Innovation Spotlight

Will AI be more transparent?: Stanford researchers just unveiled a scoring system known as the Foundation Model Transparency Index that rates 10 large AI language models on how transparent they are. The most transparent model of the 10, according to the researchers, is Meta's LLaMA 2, with a score of 54 percent. OpenAI's GPT-4 received the third-highest transparency score, at 40 percent, the same as Google's PaLM 2.

A further step in A2A: Stripe is about to provide customers of European merchants with the option to use A2A card-based payments instead of using a POS terminal. The technology is provided by one of the Stripe’s company.

📈 Insightful Data

The future of lending doesn’t need banks?: Almost half of all assets (49%) are now controlled by the shadow banking (Non-Banking Financial Institutions) sector. Despite the billions banks spend on “digital,” their market share continues to erode, as they lack products for vertical industries and are hampered by regulation. At the same time, the appetite for special loans is huge; it rose from $300B in 2010 to $1.2T in 2021 and $2.3T estimated by 2027.

Venturized is compiled and written by Ivan Taranenko, Associate at Roosh Ventures.

Roosh Ventures is a Kyiv-based entrepreneurs-led, generalist VC firm investing in Pre-seed to Series A across EU and US markets. Powered by Roosh.

Join the Roosh Ventures fam on 🐥 Twitter and 🔗 Linkedin. More about Roosh Ventures and its portfolio companies on 🌐 roosh.vc.